General Insurance in India: Ensuring Comprehensive Protection

General insurance in India has witnessed significant growth and transformation over the years, catering to diverse needs ranging from health and motor insurance to home and business protection. This sector plays a crucial role in safeguarding individuals and businesses against various risks, offering financial security and peace of mind. In this comprehensive overview, we delve into the landscape of general insurance in India, exploring its evolution, regulatory framework, key players, and the range of products available.

Evolution and Growth

The evolution of general insurance in India can be traced back to the establishment of the Oriental Insurance Company in 1947. Subsequently, other public sector insurers such as National Insurance, New India Assurance, and United India Insurance were set up in the 1950s. These companies primarily focused on providing insurance coverage for property, health, and motor vehicles, aligning with the needs of a developing economy.

The liberalization of the insurance sector in 2000 marked a significant turning point with the entry of private players, introducing competition and innovation. This led to a diversification of products and services, as well as enhanced customer service standards. Today, India boasts a robust insurance market with a mix of public and private insurers offering a wide array of general insurance products.

Regulatory Framework

The Insurance Regulatory and Development Authority of India (IRDAI) is the regulatory body overseeing the insurance sector in India. Established in 1999, IRDAI plays a crucial role in ensuring fair practices, consumer protection, and stability within the insurance industry. It regulates the licensing of insurance companies, product approvals, premium rates, and solvency margins, thereby safeguarding the interests of policyholders and promoting market efficiency.

Under IRDAI’s supervision, insurers are required to adhere to stringent guidelines regarding capital adequacy, risk management, and grievance redressal mechanisms. This regulatory framework fosters transparency, accountability, and trust among stakeholders, contributing to the overall growth and development of the general insurance sector.

Key Players in the Indian General Insurance Industry

The general insurance sector in India is characterized by a mix of public sector giants and dynamic private players, each contributing to the market with unique strengths and offerings. Below are the top 10 general insurance companies in India based on market share and reputation:

- New India Assurance Company Ltd: Established in 1919, New India Assurance is the largest general insurance company in India in terms of gross premium collected.

- United India Insurance Company Ltd: Founded in 1938, United India Insurance is another prominent player in the public sector insurance space, offering a range of policies.

- National Insurance Company Ltd: Established in 1906, National Insurance is one of the oldest insurance companies in India, providing comprehensive coverage across various sectors.

- ICICI Lombard General Insurance Company Ltd: ICICI Lombard, a joint venture between ICICI Bank and Canada-based Fairfax Financial Holdings, is a leading private sector insurer known for its innovative products and customer service.

- Bajaj Allianz General Insurance Company Ltd: Bajaj Allianz, a collaboration between Bajaj Finserv and Allianz SE, is renowned for its diverse portfolio encompassing health, motor, home, and travel insurance.

- HDFC ERGO General Insurance Company Ltd: HDFC ERGO, a joint venture between HDFC Ltd and ERGO International AG (part of Munich Re Group), offers a wide range of general insurance products tailored for individuals and corporates.

- Tata AIG General Insurance Company Ltd: Tata AIG, a joint venture between Tata Group and American International Group (AIG), provides comprehensive insurance solutions including health, motor, and property insurance.

- Reliance General Insurance Company Ltd: Part of Reliance Capital, Reliance General Insurance offers a diverse portfolio of insurance products designed to meet the needs of individuals and businesses.

- Oriental Insurance Company Ltd: One of the oldest insurers in India, Oriental Insurance provides a range of general insurance products including health, motor, and property insurance.

- Star Health and Allied Insurance Company Ltd: Star Health, specializing in health insurance, is known for its focused approach towards providing comprehensive health coverage to individuals and families.

These insurers have established themselves through a combination of strong distribution networks, innovative product offerings, and customer-centric approaches, contributing significantly to the growth and development of the general insurance sector in India.

Range of Products

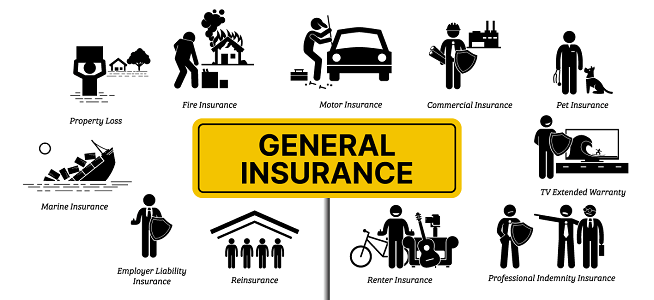

General insurance in India encompasses a wide range of products designed to mitigate risks associated with property, health, liability, and travel, among others. The most common types of general insurance products available include:

- Health Insurance: Provides coverage for medical expenses incurred due to hospitalization, surgery, and other healthcare needs. Health insurance policies may also offer additional benefits such as cashless hospitalization, critical illness cover, and maternity benefits.

- Motor Insurance: Mandatory under the Motor Vehicles Act, motor insurance includes two main categories: Third-Party Liability Insurance and Comprehensive Insurance. It provides financial protection against damages or losses caused to a vehicle due to accidents, theft, or natural disasters.

- Home Insurance: Protects homeowners against losses or damages to their property and belongings caused by fire, burglary, natural calamities, and other perils. Home insurance policies may also cover liabilities arising from accidents or injuries on the premises.

- Travel Insurance: Offers coverage for unforeseen events during domestic or international travel, including trip cancellations, medical emergencies, lost baggage, and personal liability. Travel insurance policies are tailored to meet the specific needs of travelers and ensure peace of mind.

- Business Insurance: Includes various types of insurance products such as fire insurance, marine insurance, liability insurance, and commercial vehicle insurance, designed to protect businesses from financial losses arising from operational risks.

- Personal Accident Insurance: Provides financial compensation in the event of accidental death or disability resulting from accidents. Personal accident insurance policies offer lump-sum payments or periodic payouts to the insured or their beneficiaries.

- Crop Insurance: Aimed at farmers and agricultural producers, crop insurance provides protection against crop failures due to natural calamities, pests, diseases, or adverse weather conditions. It helps mitigate financial losses and stabilize income for farmers.

These products cater to the diverse needs of individuals, families, and businesses, offering financial security and resilience against unforeseen circumstances.

Challenges and Opportunities

While the general insurance sector in India has achieved significant growth and expansion, it faces several challenges and opportunities:

- Underinsurance: Despite increasing awareness, a large segment of the population remains underinsured or uninsured, particularly in rural areas. Efforts are needed to enhance insurance penetration and educate consumers about the importance of insurance coverage.

- Technological Integration: Advancements in technology, such as digital platforms, artificial intelligence, and data analytics, present opportunities for insurers to enhance customer engagement, streamline operations, and develop innovative insurance solutions.

- Regulatory Compliance: Compliance with regulatory requirements and evolving guidelines poses challenges for insurers, necessitating continuous adaptation and adherence to best practices.

- Healthcare Costs: Rising healthcare costs and changing demographics underscore the need for comprehensive health insurance solutions that address affordability and accessibility issues.

- Climate Change and Natural Disasters: Increasing frequency and severity of natural disasters necessitate robust risk management strategies and insurance products that provide adequate coverage against climate-related risks.

Despite these challenges, the general insurance sector in India is poised for continued growth driven by increasing disposable incomes, urbanization, regulatory reforms, and a growing awareness of risk management. Insurers are leveraging innovation, digitalization, and strategic partnerships to expand their market presence and cater to evolving customer needs.

General insurance in India has evolved into a dynamic and competitive industry, offering a wide range of products to protect individuals, businesses, and assets against various risks. The sector has witnessed significant growth with the entry of private players, enhancing product diversity, customer service standards, and market competitiveness.

With a robust regulatory framework provided by IRDAI, insurers are committed to upholding transparency, fairness, and consumer protection. The top 10 general insurance companies in India, both public and private, play a pivotal role in driving innovation, expanding market reach, and ensuring comprehensive coverage for policyholders.

Looking ahead, the sector is poised for further growth and transformation fueled by technological advancements, regulatory reforms, and changing consumer expectations. As India’s economy continues to develop, general insurance will remain indispensable in safeguarding financial well-being and promoting resilience against uncertainties.

Reach us at: MeraBima , Near Sunit Nursing Home, Opp Sector-17, LIC Road, Kurukshetra, 136118, India

Call us at: +91-98966-77625. Email us at: hr@merabima.in